We Offer the Most Competitive Rates and Fees in the Industry

American Profit Consulting offers the most competitive program in the industry today: Interchange Pass Through or IPT. Our program provides the lowest overall cost of service, by passing through the direct cost for Interchange Fees and Assessments with a small markup in order to provide your business with the most reliable service and support.

It is important to understand that comparing quotes from one merchant service provider to the next can be very difficult. Rates will vary depending on the pricing method, type of card, the manner in which the card is processed and your adherence to qualifying criteria associated with the sale.

Interchange Pass Through or IPT

As a business owner you have enough to do without having to figure out how Credit Card Interchange works. The good news is it's not that complicated. Interchange consists of different percentage and transaction fees that an Issuing Bank (Cardholder's Bank) charges an Acquiring Bank (Merchant's Bank)to process one of their cardholder's credit cards. Interchange is another word for “cost.” There are hundreds of different interchange fees, what is important is to understand that interchange is essentially the wholesale rate that banks charge each other in order to process a credit card transaction. In order to pay the lowest fees when processing credit cards, a merchant's goal is to pay as close to interchange as possible.

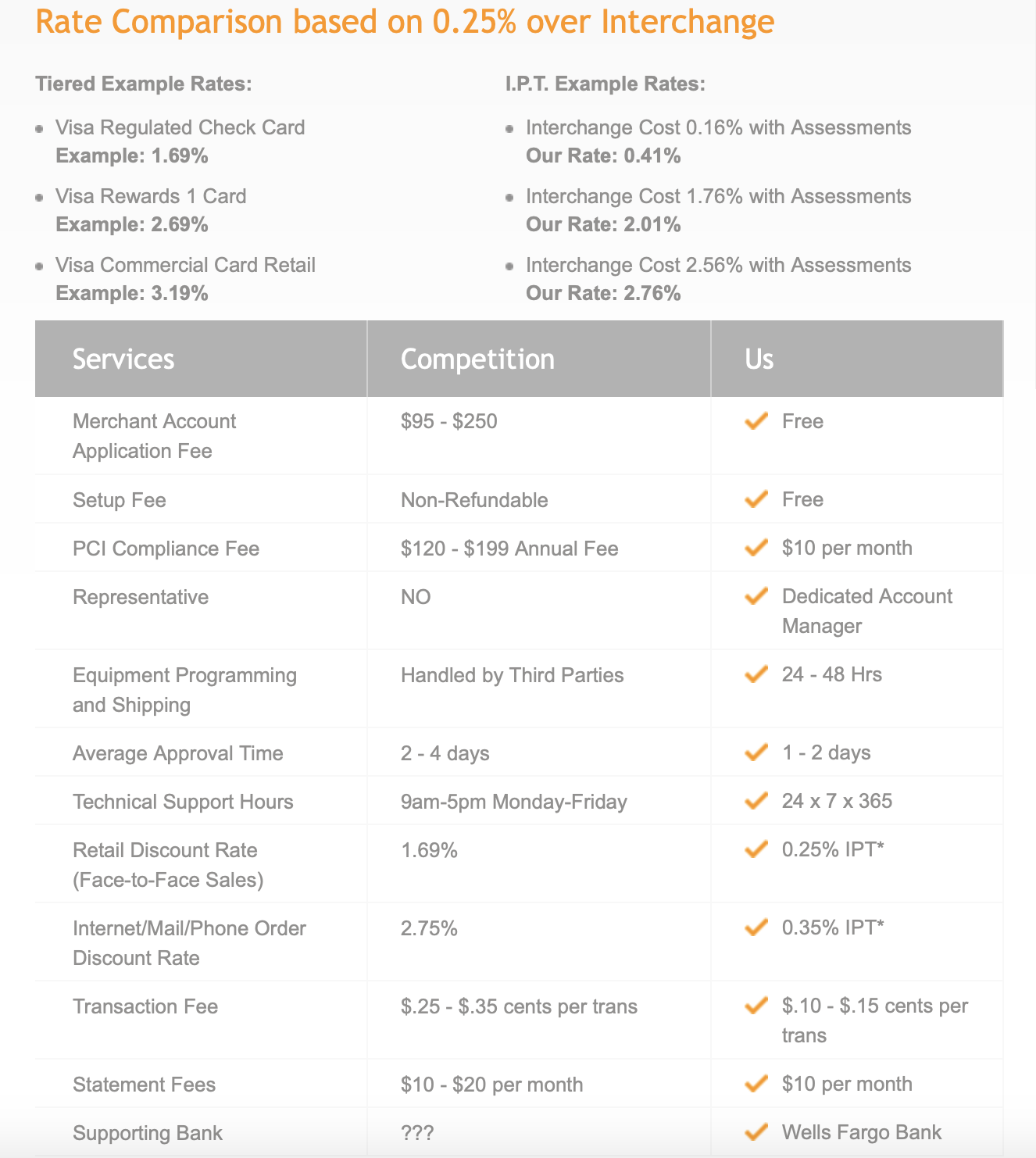

Rate Comparison based on 0.25% over Interchange

Tiered Example Rates:

· Visa Regulated Check Card Example: 1.69%

· Visa Rewards 1 Card Example: 2.69%

· Visa Commercial Card Retail Example: 3.19%

I.P.T. Example Rates:

· Interchange Cost 0.16% with Assessments Our Rate: 0.41%

· Interchange Cost 1.76% with Assessments Our Rate: 2.01%

· Interchange Cost 2.56% with Assessments Our Rate: 2.76%

Beware of Tiered Pricing Programs

Most merchant account providers quote a "rate as low as" rate, this rate is generally what they call their Qualified Rate. Most tiered merchant accounts have a base rate plus two additional tiers that carry a surcharge when the type of card or acceptance method does not fall into the qualified tier. In this type of pricing method, you are almost always paying well above the interchange cost for all surcharged transactions. Interchange Pass Through Programs only have one discount rate that you pay above the True Cost to accept a card.

3-Tier Merchant Rate Structure:

· Qualified Discount Rate (Base Rate) Example: 1.69%

· Mid Qualified Surcharge (Qualified Rate + Mid Qualified Surcharge) Example: 1.69% + 1% = 2.69%

· Non Qualified Surcharge (Qualified Rate + Non Qualified Surcharge) Example: 1.69% + 1.5% = 3.19%

4-Tier Merchant Rate Structure:

· Debit Discount Rate (Check Cards Only) Example: 1.29%

· Qualified Discount Rate (Qualified Rate) Example: 1.69%

· Mid Qualified Surcharge (Qualified Rate + Mid Qualified Surcharge) Example: 1.69% + 1% = 2.69%

· Non Qualified Surcharge (Qualified Rate + Non Qualified Surcharge) Example: 1.69% + 1.5% = 3.19%

* The Savings Averages concerning our competitors are based on Statement Analysis Data collected nationwide by MerchantService.com, Inc and Our Affliates. The data is collected and displayed dynamically by our ISO / Agent statement analysis application.